Electricity Bills in Pakistan have become unbearable. This increase has led to increased frustration and anger among businesses and households alike. The increasing cost of electricity is a pressing concern, especially with anticipated hikes in the coming fiscal year. With the price of electricity reaching an exorbitant Rs60 per unit compared to the global average of Rs25-30, there is an urgent need for solutions. We will delve deep into the fundamental issues plaguing Pakistan’s power sector and propose two-step reform that can significantly reduce electricity prices forever.

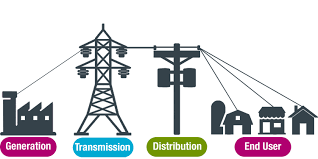

Understanding the Power Sector

To address the electricity pricing issue, it’s crucial to understand the structure of Pakistan’s power sector, which consists of three main components: generation, transmission, and distribution.

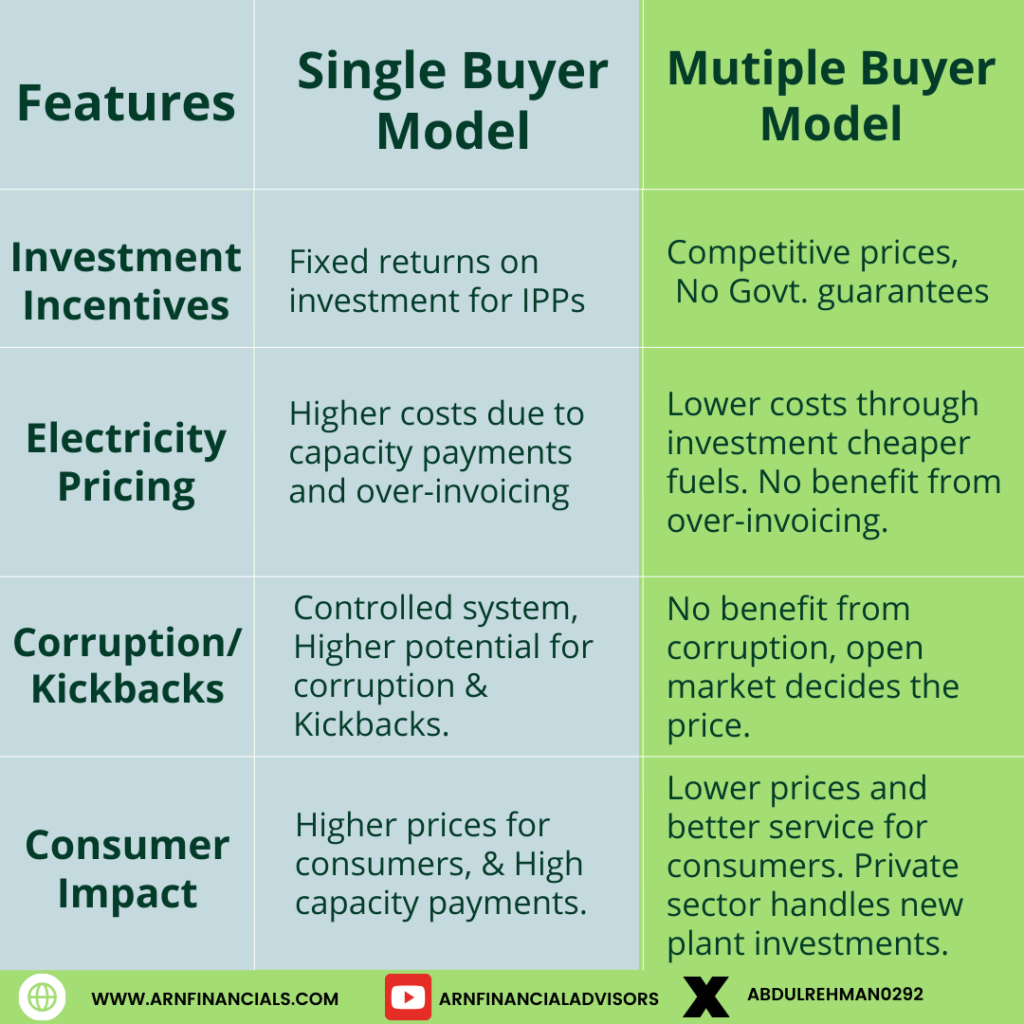

1. Generation: The generation of electricity in Pakistan is a mix of public and private sector efforts. Private Independent Power Producers (IPPs) and government entities generate electricity using various fuels like gas, nuclear, hydel, and coal. However, the single buyer model limits the sale of electricity strictly to the government, preventing direct transactions even between neighboring entities, such as an industry and a local power plant. This system necessitates capacity payments, where IPPs are compensated for being available to generate electricity, regardless of actual production. This model encourages the selection of secure, often more expensive, imported fuels and results in higher overall electricity costs.

2. Transmission: Similar to generation, the transmission segment involves significant government investment. Transmission infrastructure, often outdated, requires modernization to enhance efficiency and reduce losses. The fixed returns guaranteed by the government on these investments further perpetuate inefficiencies, as private entities have little incentive to innovate or improve operations.

3. Distribution: The distribution phase, managed primarily by government-owned companies except for K-Electric, faces substantial issues like electricity theft and poor bill recovery. A complex web involving bill payers, meter readers, and local officials contributes to these losses, which ultimately are recovered from honest consumers through higher tariffs.

Key Problems and Solutions

The high cost of electricity generation can be attributed to four primary issues:

1. Imported/Wrong Fuel: IPPs often prefer imported fuels for their security of supply, driving up costs. Without the single buyer model, power producers would be incentivized to choose more cost-effective, locally available fuels.

2. Over-Invoicing in Plant Costs: There are allegations that plants are over-invoiced to earn higher capacity payments. Eliminating the single buyer model would reduce such incentives, promoting cost-effective practices.

3. Loan Duration: Short loan repayment periods (e.g., 12 years) on plants designed to operate for 50 years result in higher capacity payments. In a deregulated market, financial decisions would be more aligned with long-term cost minimization.

4. Balancing Load and Capacity Payments: Misalignment between load shedding and capacity payments leads to inefficiencies. A market-driven approach would shift risk to investors, encouraging more prudent capacity planning.

Proposed Reforms

1. End the Single Buyer Model: Allowing multiple buyers and sellers in the electricity market would foster competition, driving prices down. Power plants would be motivated to produce electricity at the lowest possible cost to remain competitive, while distribution companies (DISCOs) would seek the most cost-effective suppliers to maximize their margins.

2. Privatize Distribution Companies: Privatizing DISCOs or entering long-term operational agreements linking profits to bill recovery would create incentives for efficiency and reduce losses from theft and non-payment. Operators with a vested interest in profitability would implement more robust measures to ensure bills are paid, significantly reducing distribution losses.

Conclusion

The inefficiencies in Pakistan’s power sector can be largely attributed to the single buyer model and systemic issues within the distribution segment. By transitioning to a multi-buyer model and privatizing distribution operations, Pakistan could see a substantial reduction in electricity costs. These reforms would create a competitive environment, encouraging both generation and distribution sectors to optimize operations and reduce prices. Ultimately, these changes could halve electricity costs in a few years, providing much-needed relief to consumers and stimulating economic growth.

Implementing these reforms requires political will and public support. By advocating for the end of the single buyer model and the privatization of DISCOs, stakeholders can push for a more efficient and cost-effective power sector, ensuring a brighter and more affordable future for all Pakistanis.

To tackle the growing challenges of electricity costs in Pakistan, it’s essential to have a deeper understanding of financial and economic systems. Our Investing Masterclass provides valuable insights into these complex topics, helping you make informed decisions in today’s challenging financial landscape. For personalized guidance on navigating these economic shifts and making strategic investments, our 1-on-1 Advisory Services offer expert advice tailored to your unique financial goals. By understanding these dynamics, you can better position yourself to mitigate the impact of rising energy costs and protect your financial future.