It is the most common perception among people that the stock market is a risky endeavor. It is usually believed that investing in the stock market leads to failure, scams & low returns. However, data tells an entirely different story. After analyzing the data of the last 25 years, it is evident that investing in the stock market is the best asset class in Pakistan. In this article, we will be breaking this perception and explaining to you the kind of wealth you are missing out on by not investing your savings in the stock market for the long term.

In Pakistan, we usually follow the same pattern set by our predecessors and do not look into the growing trends of the Stock market. There are five primary investment avenues in Pakistan: Fixed income, Gold, Real Estate, US Dollars and the Stock Market. Each option has its own cycle of growth, risks & returns.

Government bonds and bank deposits are examples of fixed income investments that are well-liked because of their consistency and predictable returns. Your savings would have increased by about 10-12 times if you had invested in fixed income mutual funds, bank savings accounts, or national savings 25 years ago. When compared to conventional bank deposits, National Savings Schemes (NSS) in Pakistan provide competitive interest rates. Even if your wealth is safe, its actual worth could gradually decrease because these returns frequently fall short of the inflation rate in Pakistan.

Pakistani investors have historically preferred gold because they view it as a hedge against inflation and unstable economic conditions. Price of gold, just like most asset classes, experiences volatility. Recent changes in the world economy have demonstrated that, although gold can offer security, its value is subject to change depending on world events. If you had made a gold investment 25 years ago, your savings would have increased by roughly 35–40 times.

An extensive platform for investing in a variety of companies across multiple sectors is provided by the Pakistan Stock Exchange (PSX). PSX has outperformed gold and fixed income investments in terms of returns, an incredible increase of 66 times. The long-term growth potential of the stock market makes it an appealing choice for investors hoping to accumulate wealth over time, even in times of volatility.

In Pakistan, real estate is still one of the most well-liked investment options since many people view it as a physical and stable asset. Residential and commercial real estate investments have historically yielded returns of about 20–25 times. Real estate investments, however, are less liquid than other investment possibilities and demand a significant amount of capital. Real estate’s illiquidity can be a drawback, particularly when rapid access to funds is required. Such drawbacks and average returns over the longer term are inconsistent with why the masses consider it to be the best saving vehicle in Pakistan.

A refuge of safety during economic unrest is the dollar. If you had bought dollars in 1999 for Rs50, your investment would today be worth Rs280, a meager five and a half times return in the last 25 years. Although storing dollars helps shield against the Pakistani rupee’s depreciation, they don’t produce income or dividends.

In actual terms, the stock market has outperformed all other asset groups. This outstanding result emphasizes how important it is to assess investments over a 20–25 year period in order to distinguish between long-term earning potential and speculation. With enough understanding and historic study of the stock market, it is possible to avoid scams and become partners with powerful businessmen in Pakistan.

The greater returns of the stock market are because it is a platform where investors & citizens of Pakistan can become equal partners with the nation’s most successful business groups. For instance, investing in businesses like Engro Corporation/Lucky Cement, you can become equal partners with Mr. Hussain Dawood/Mr. Muhammad Ali Tabba. The stock market has produced pre-tax average returns of around 66 times during the past 25 years. Companies with more moderate growth are balanced by those with returns as high as 150 times.

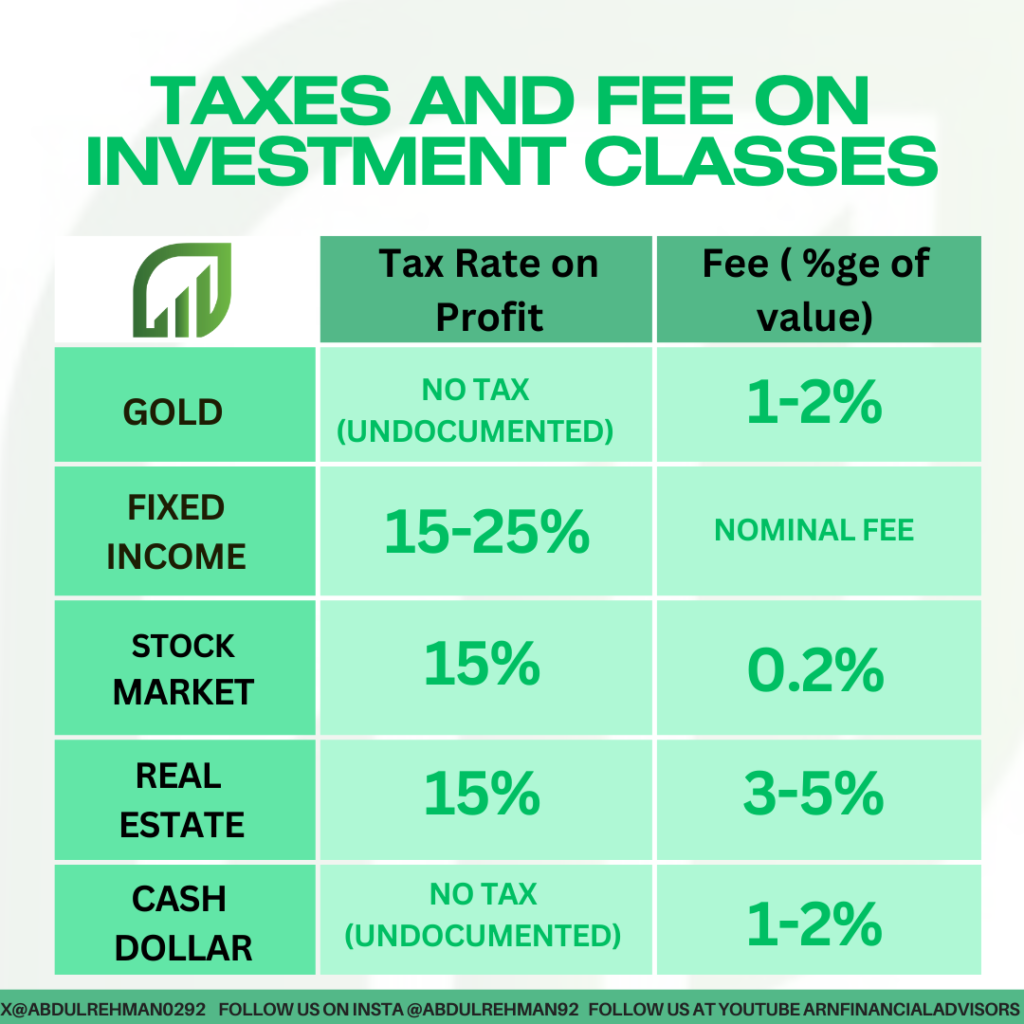

When assessing investment options, taxes and fees must be taken into account. Fixed income investments are usually taxed at a rate of about 15%. According to current tax regulations, real estate and stock market investments can have tax rates ranging from 0% to 15%, particularly if held for more than six years. Gold, which is frequently associated with the black market, is part of undocumented economy.. Fixed income and stock market transactions have nominal fees, usually around 0.2%. Real estate transactions have higher fees, such as withholding taxes, provincial fees, and broker fees totaling roughly 3-5% of the property value. Dealer commissions for gold trading are 1–2%.

In conclusion, not investing in the stock market can greatly reduce potential returns on your savings. While it carries price volatility risks, the greater risk lies in not investing and missing out on the opportunity to grow your wealth significantly in the longer term. By understanding the stock market, you can potentially achieve returns far exceeding those of other asset classes.

As Pakistan continues to develop economically, the stock market remains a vital avenue for investors seeking to enhance their financial security and achieve their financial goals. It is crucial for investors to consider the stock market as a key component of their investment strategy to safeguard against the risks of inflation and ensure robust financial growth. As you finalize your investment strategy, consider the long-term benefits and the unique opportunities presented by the stock market.

At ARN Financial Advisors , we believe that understanding the long-term benefits of the stock market is crucial for anyone looking to build significant wealth. While volatility may seem intimidating, the stock market has consistently outperformed other asset classes over time. We belive Stock market is where you should invest your savings and make your way towards long term wealth creation. In our Masterclass, we teach how to time these cycles and how to grab potential opportunities for investment.